A buy now, pay later platform that allows users to pay for purchases at their own pace.

About the project

Plater is a PoC of a BNPL (Buy Now - Pay Later) platform. This is a Radency R&D project which allowed us to get a better feel for the intricacies of such a FinTech solution. The goal of this platform is to provide zero-fee loans for customers from one side and an additional source of clients for the merchants. Plater allows consumers to make purchases and pay them back by splitting the cost into smaller monthly interest-free installments.

Product features

Client's side

Instant payment

Clients can buy goods on the merchants' websites and pay using Plater instantly without leaving the current page.

Advanced security

We detect suspicious logins based on data about used devices and users' geolocation when possible.

Mobile app

All the core features from the web application are available in the mobile app.

Merchant's side

Multitenancy

Each merchant has its own account where he can set discounts, list goods that can be bought using Plater, and track their cash flow.

Dashboards

Merchants can see aggregated data about their loans and detect trends and anomalies based on that data.

Role management

It is possible to assign different roles and permissions for users that are part of merchant account.

Services

UI / UX Design

Software Engineering

Quality Assurance

Technologies

-

Frontend: React / Redux / Sagas / Tailwind

-

Backend: NodeJS / Express /

-

DB: Postgres / Sequelize /

-

Cloud: Docker / GCP

-

Mobile: Flutter

Product Team

3 engineers

1 designer

1 QA

How it works

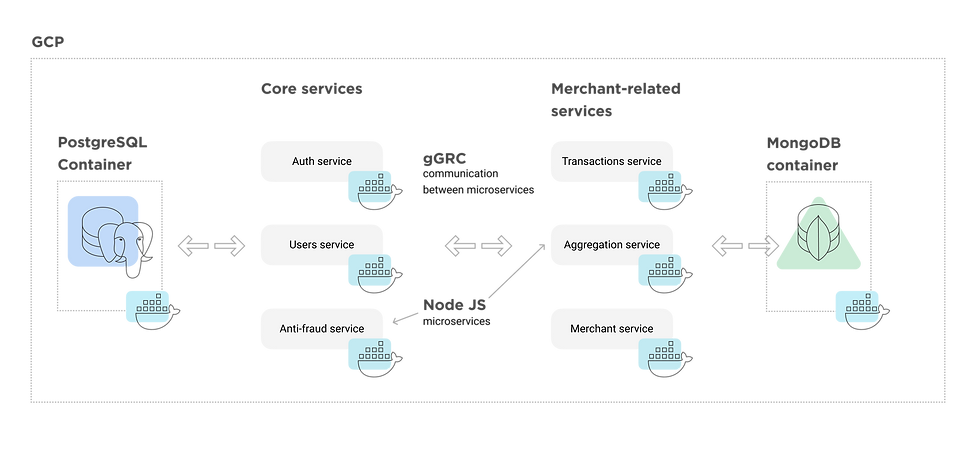

Plater backend structure

Radical Efficiency illustrations

Cloud Deployment

Using GCP Engine service and Docker to deploy our application allowed us to promptly see the first outcomes. And the same time we were able to reduce expenses on human resources as the process was performed by one of the developers without the necessity to involve dedicated DevOps.

Mocked merchant websites using NextJS

We used NextJS to speed up merchants' website creation. Functionality like SEO, localized routing, and internationalization comes out of the box. This allowed us to focus more on domain-specific logic rather than working on generic features.